When Your Business Grows Faster Than Your Advisory Support

One advisor is no longer enough.

As businesses scale, decisions become more complex — taxes, entity structure, risk, growth, succession. Yet most business owners are still relying on isolated advice from professionals who rarely work together.

Engarde Financial Group helps business owners bring clarity to complexity through a Virtual Family Office — a coordinated team approach designed to support growth, protect value, and plan ahead.

THE REAL PROBLEM

Most business owners don’t lack advisors. They lack coordination.

CPAs focused on compliance, not proactive strategy

Financial professionals operating in their own lane

Attorneys are involved only after decisions are made

Conflicting advice with no one accountable for the full picture

When advisors don’t collaborate, you carry the risk — and often discover gaps too late.

Growth without coordination leads to:

Missed planning opportunities

Inefficient structures

Unnecessary exposure

Reactive decisions instead of intentional ones

This isn’t about bad advisors. It’s about a missing framework.

WHY A FAMILY OFFICE EXISTS

For decades, the most successful families have solved this problem through Family Offices — teams of specialists who work together to oversee every major financial and business decision.

The challenge?

Traditional Family Offices typically require $50 million or more in assets and come with significant overhead.

A Virtual Family Office delivers the same coordinated approach without the cost or complexity by bringing the right specialists together when and where they’re needed.

Think of it as having everyone at the same table, aligned around one plan.

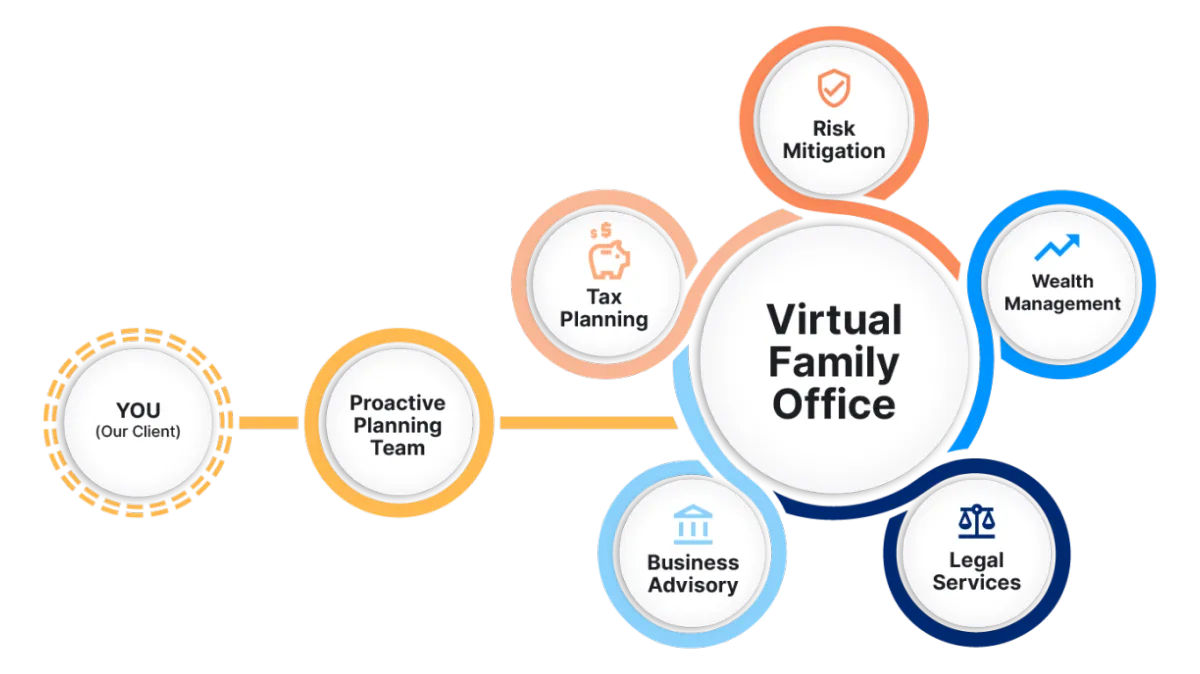

HOW ENGARDE SERVES AS YOUR FAMILY OFFICE ADVISOR

Engarde Financial Group acts as your central point of coordination.

We don’t replace your existing advisors — we align them.

And when specialists are missing, we bring the right ones in.

Through our Virtual Family Office framework, we coordinate expertise across areas such as:

Advanced tax planning

Entity and compensation strategy

Business growth and value optimization

Risk management and asset protection

Exit and succession planning

Long-term wealth and legacy strategy

You remain in control.

We ensure decisions are made with the full picture in mind.

YOUR PERSONAL VIRTUAL FAMILY OFFICE

One Relationship. Complete Solutions. Coordinated Specialists.

WE COVER EVERYTHING YOU NEED

Tax Planning

Advanced tax strategies your CPA never mentioned

Charitable structures that benefit you AND charities

Business tax optimization

Tax credit opportunities

Business Advisory

Exit strategy development

Succession planning that protects family

Business valuation optimization

Growth acceleration strategies

Operational improvements

Risk Mitigation

Asset protection before lawsuits hit

Insurance gaps most agents miss

Litigation shields

Privacy preservation

Coordinated coverage analysis

Wealth Management

Alternative investments

Tax-efficient portfolio design

Retirement optimization

Private market access

Institutional strategies

Legal Services

Trust structures that protect generations

Entity formation for maximum protection

Family governance frameworks

Tax-efficient wealth transfers

Coordinated legal strategies

Steps To Build Your Virtual Family Office

Step 1 - Discover

You take 10 minutes to complete our proprietary VFO Diagnostic, which automatically identifies opportunities across all areas of your personal and business landscape.

Step 1 - Discover

You take 10 minutes to complete our proprietary VFO Diagnostic, which automatically identifies opportunities across all areas of your personal and business landscape.

Step 2 - Coordinate

Your dedicated Proactive Planning Team assembles the exact specialists you need from our Virtual Family Office.

Step 2 - Coordinate

Your dedicated Proactive Planning Team assembles the exact specialists you need from our Virtual Family Office.

Step 3 - Execute

Seamless implementation of coordinated strategies with one point of contact overseeing everything.

Step 3 - Execute

Seamless implementation of coordinated strategies with one point of contact overseeing everything.

Who Is This For?

Our Virtual Family Office is designed for:

Business owners whose growth has outpaced their advisory structure

Individuals earning significant income or building meaningful equity

Owners thinking beyond this year toward long-term value and succession

Those who already know tax prep alone isn’t enough

This is not a transactional or product-driven relationship.

It’s strategic, coordinated, and forward-looking.

Learn More

Not sure if a Virtual Family Office is right for you?

Facebook

Instagram

TikTok